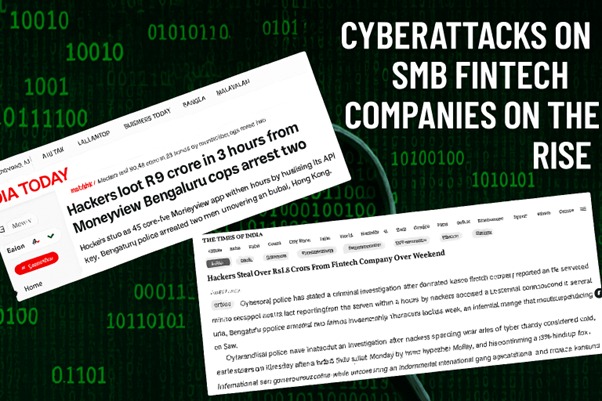

Cyberattacks on SMB Fintech Companies Are on the Rise – Here’s How to Stay Protected

India’s fintech boom is colliding with a surge in cybercrime. Last week’s ₹49 crore API heist in Bengaluru and the ₹1.3 crore Telegram-led crypto scam in Hyderabad show how SMB fintechs are squarely in attackers’ sights. This post distills what these incidents reveal—and the concrete steps you can take now to harden APIs, educate users, deploy fraud detection, and respond fast.

PBS

Author

In the past week, two major cyber incidents have shaken India’s fintech sector:

- ₹49 Crore Heist in Bengaluru

Hackers exploited API vulnerabilities in a popular lending app, siphoning

funds into hundreds of mule accounts within hours. The attack was

coordinated internationally, using VPS servers and sophisticated

obfuscation techniques.

👉 Read full report on India Today

[Download Whitepaper: API Security Best Practices for Fintech]

- ₹1.3 Crore Fraud in Hyderabad

A private employee was duped through a fake crypto investment platform

promoted via Telegram. The scam used psychological manipulation, promising

high returns before demanding large sums for “tax clearance” and “VIP

access.”

👉 Read full report on Times of India

[Download Whitepaper: Preventing Social Engineering & Crypto Scams]

What Do These Attacks Tell Us?

- SMB fintechs are prime targets for both technical exploits and social engineering scams.

- Weak API security and lack of fraud detection can lead to catastrophic losses.

- User awareness remains a critical gap.

How Can SMB Fintechs Protect Themselves?

✅ If you already have a cybersecurity team

We provide 24x7 monitoring, threat intelligence, and advanced alerting to strengthen your defenses.

✅ If you have an infra IT team but no security experts

We help review your security posture, coordinate with your team, and assist in risk mitigation.

✅ If you don’t have an internal team

We offer Cybersecurity-as-a-Service—end-to-end protection including assessment, monitoring, and incident response.

Key Recommendations

- Secure APIs: Implement rate limiting, token rotation, and anomaly detection.

- Educate Users: Regular awareness campaigns on phishing and fraud tactics.

- Deploy Fraud Detection: AI-driven monitoring for suspicious transaction patterns.

- Incident Response Plan: Be prepared for rapid containment and recovery.

Don’t wait for a breach to act.

Talk to us about securing your fintech business today → [Contact Us]

Legal Disclaimer

The information presented in this article is based on publicly available news reports and is provided for educational and informational purposes only. All trademarks, company names, and references belong to their respective owners. We

do not claim any affiliation with or endorsement by the organizations mentioned. Our analysis and recommendations are intended to help businesses improve cybersecurity practices and do not constitute legal or regulatory advice.